OPERATIONS

What We Do

The Tatitlek Corporation delivers mission-critical solutions to government agencies, defense contractors and high profile private sector customers at locations throughout the United States and around the world. TTC has formed subsidiary companies with diverse expertise to deliver high-quality services within multiple federal sectors. Every TTC subsidiary is led by highly experienced management specialized in their field and driven by a trained workforce who achieve successful outcomes for our clients through a dedication to innovative strategies, outstanding outcomes for our clients and mutually beneficial collaborations.

Professional and Administrative Support Services

Technical Services

Installation Support Services

DIFFERENTIATORS:

• Unique Federal Government Procurement Advantages

• $100M Direct Award Thresholds

• Portfolio of Small Disadvantaged (SDB) & 8(a) Companies

• SDB Credit for Subcontracts

• Strong Financial Stability

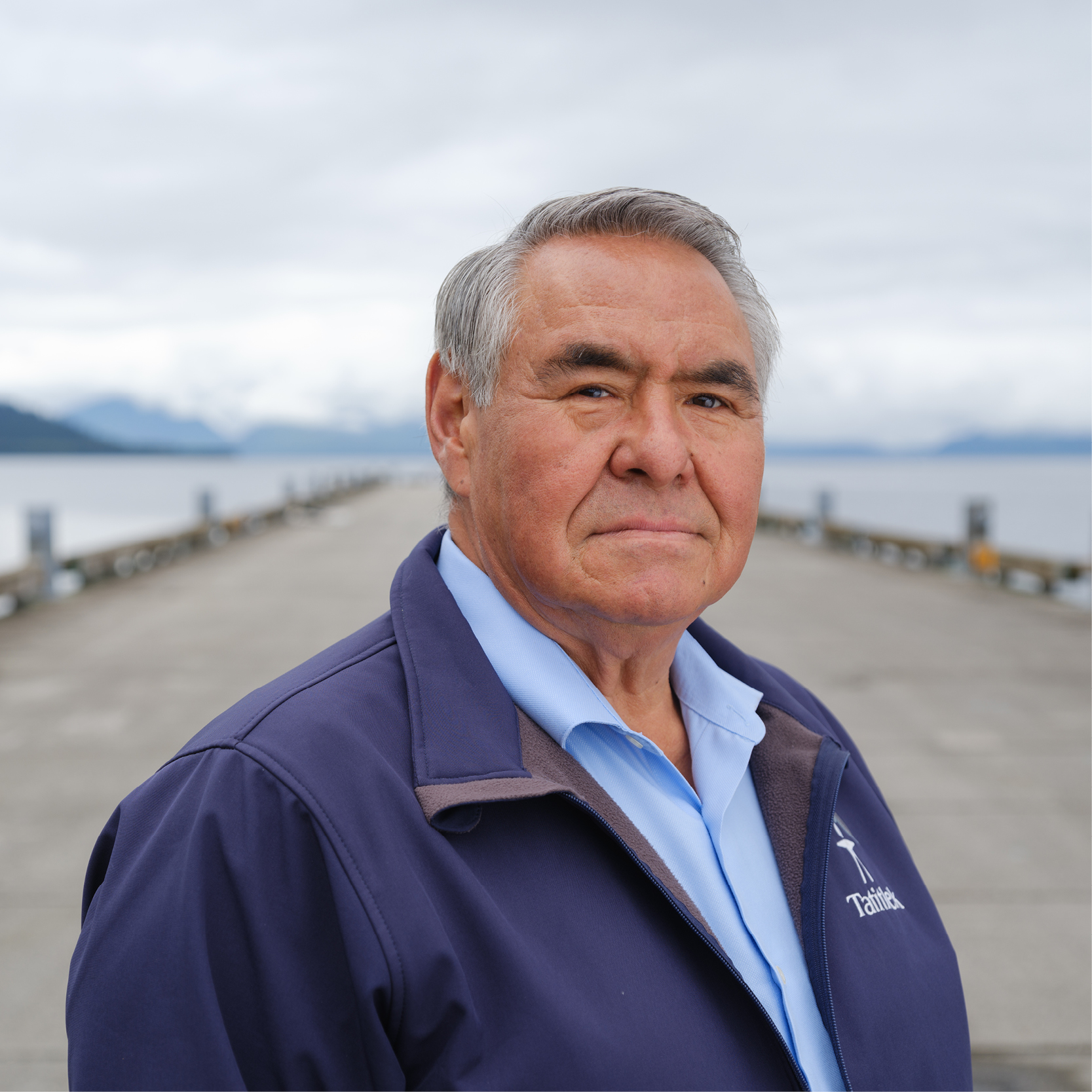

ROBERT C. (CHRIS) VIRAMONTES, P.E.

CHRIS VIRAMONTES

MARK WAMSHER

MARK WAMSHER

PAUL FONDREN

PAUL FONDREN

The advantages of partnering with a TTC 8(a) company

8(a) is a business-development program from the U.S. Small Business Administration designed to help firms owned and controlled by socially and economically disadvantaged people, including Alaska Natives. TTC subsidiary companies that are currently certified under the SBA 8(a) program have eligibility for unique procurement advantages with federal clients.

Any corporation, regardless of size, that partners with a TTC company for a specific contract is also eligible for the same 8(a) advantages, which include:

- Sole Source: ANC 8(a)s may be awarded sole-sourced federal contracts of any size. Unlike a non-tribally owned 8(a), a TTC 8(a) company is not subject to the $3.5 million cap on sole-source awards. 13 CFR 124.506(b)

- Non-Protest: Sole-source awards made to TTC 8(a) companies cannot be protested. 13 CFR 124.517(a)

- SDB Credit for Subcontracts: Subcontracts awarded to a TTC 8(a) can be counted towards the prime contractor’s goal for subcontracting with a small, disadvantaged business and small business concerns, regardless of the TTC company’s size or SBA certification status. The credit may be taken where the TTC 8(a) company is no longer small under SBA regulations. 48 CFR 19.703(c)(1)

- 5% Incentive Program: Department of Defense contractors who offer subcontracts to a TTC 8(a) company may be eligible to receive 5% of the total value of the subcontract as an incentive under the Buy Indian Act. Per Section 504 of the Indian Financing Act of 1974 (25 U.S.C. ? 1544) and also referenced under (FAR 52.226-1).